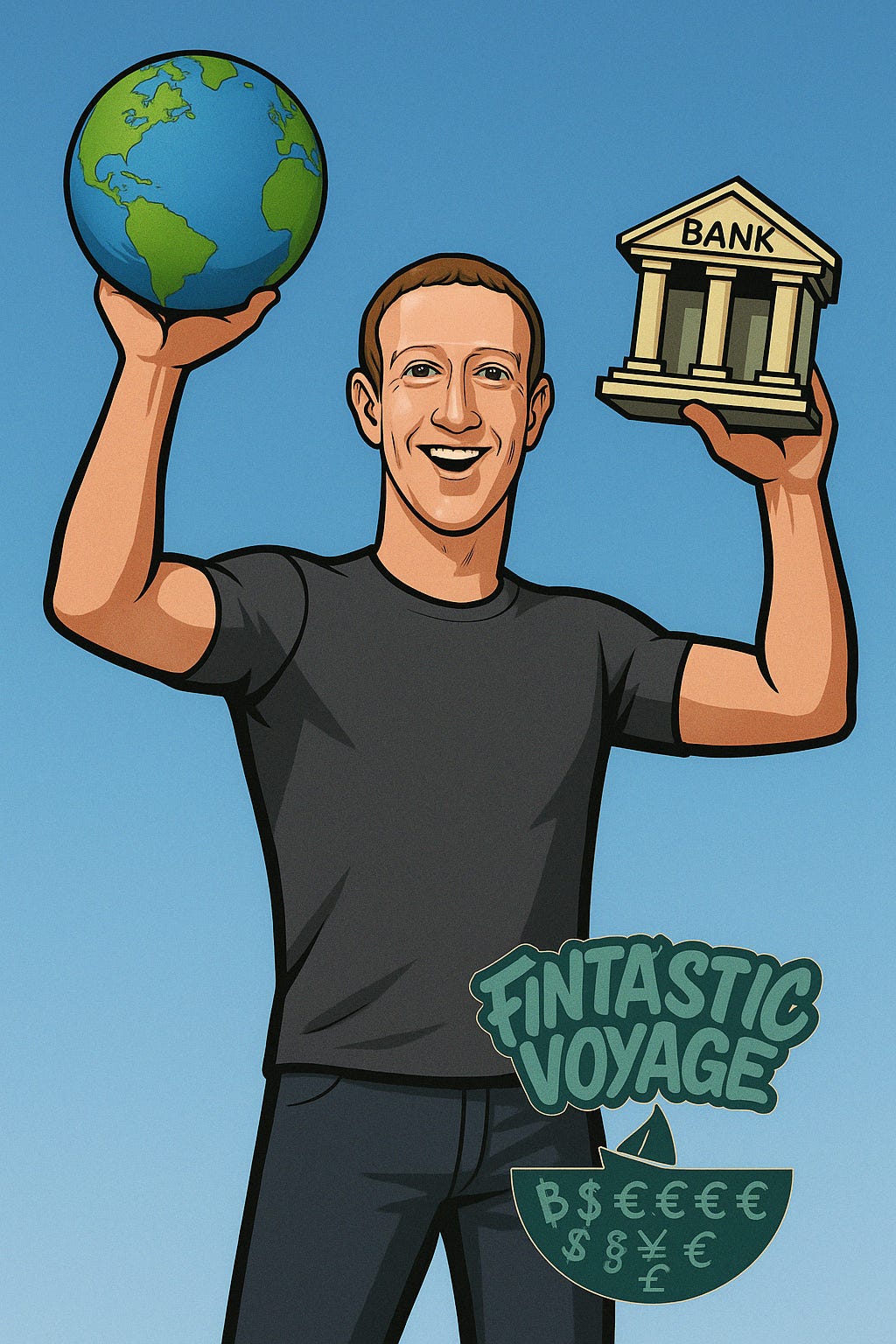

WhatsApp isn’t a bank (yet). It’s the rails. And everyone’s already on board.

Or what Meta could do if they lose this antitrust case.

Welcome to WhatsApp Bank: A Day in the Life of the Most Useful App on Earth

It’s April 16th, 2028. You just woke up after a fever dream of a time past when you actually had to file your own taxes. AI does this now.

Despite one monkey off your shoulder, you still have other financial responsibilities. Your kid’s school fees are due. And you just got a passive-aggressive message from your mom about not topping up her electricity again. Maurice and Zahid still haven’t paid you back for that group trip to Lamu. You stretch, unlock your phone, and open the app that runs your life.

It’s not Instagram. You couldn’t stand seeing ads for an AI “companion” in your feed anymore so you deleted it years ago. You open WhatsApp and start the day...

But first, how did we get here? Let’s go to the present day…

Meta, WhatsApp, and the Antitrust Storm

I did not expect such a vicious blow to be dealt to crony capitalism. The inauguration contributions and the deputizing of the All-In bros kept this one off my “WTF is happening to the World” bingo card.

The FTC is bringing an antitrust suit against Meta to court alleging that Meta engaged in anti-competitive behavior by acquiring Instagram (2012) and WhatsApp (2014). The allegation is Meta did this to neutralize threats to its dominance in social networking. Ben Thompson’s Stratechery has a great analysis on the case itself. Personally, it would not at all be surprising if Meta might have had a “buy or bury” approach. No one really trusts Meta/Facebook and very little healing has been done to remedy that.

Regardless if Insta was buried or not, I don’t think Meta actually had a good mobile strategy so they bet they could make it work and paid $1.1 billion for Instagram. That bet paid off. Instagram’s estimated 2024 revenue was $70 billion and the estimate revenue since 2017 is $291 billion dollars. That’s arguably a better investment than Bitcoin. But what about WhatsApp?

WhatsApp is the most widely used communication platform on the planet with 2 billion monthly active users. I use WhatsApp to run a large chunk of our business - mostly because all of our customers also run their businesses on WhatsApp. It’s a critical piece of infrastructure for operating in emerging economies. That being said, I don’t think the $19B spent on WhatsApp has had the same clear financial return and Instagram for Meta. Let’s be generous and say that WhatsApp for Business makes up ALL of Meta’s non-advertising revenue from 2024 - that means WhatsApp revenue was, at most, $1.7B last year. I would take an 8.9% annual return on my investment given the return on my checking account but I don’t think Zuck got what he was after.

A key point of the case is that Meta's consolidation of platforms has stifled innovation and competition. This narrative increasingly resonates as platforms like WhatsApp grow beyond messaging. WhatsApp has 2 billion users on an extremely reliable, low friction interface, is in a dominant position in major markets like India, Brazil, and Nigeria. And it’s already being used for P2P payments.

…back to you in 2028…

Meta was broken up under the Sherman Antitrust Act. What happened next?

💥 Freedom Looks Good on You

After regulators finally cracked open Meta like a pistachio, WhatsApp was pried from the kung fu death grip of Zuck’s golden shares and spun out as a foundation with teeth. It’s like the Linux Foundation, but sexy. They ditched the surveillance playbook and instead recruited a few heavy hitters from major banks, PSPs, regulators, maybe even a retired crypto VC or two with a deep bent for open source software ($BTC just hit $500k after the latest FOMC). Governance became boring in the best way — clear mandates, strong checks, ruthless transparency. No tokens, no cults, no NFTs of goats.

Just a protocol, built for people who move money more than they move memes. It’s trust, rebuilt.

💸 You Send a Message. It Sends the Money.

Now, that message to your mom? It is the payment.

“Here you go, ma. I love you” (never forget to say I love you).

You tap send. Done. No other app. You didn’t scan a QR code. You didn’t have to click through seven drop downs about some BS EU regulations. You didn’t click a phishing link disguised as a fintech startup with a four-letter name and no vowels.

PIX in Brazil, UPI in India, M-Pesa in Kenya. Even TigoPesa in Tanzania which is where your paid your Moms ZECO bill. They’re all plugged in. The borders between chat and money and other money have been erased.

Your boda guy says “send 300 boss” “ok” — Paid.

Your designer in Lagos sends your company an invoice for $3000? One message, and then your finance manager also send a message. It’s settled.

Your friend in Cape Town who sent you that “just split it after” message? When you woke up the next day, they got a prompt to “Request with Fire Emoji.” And you responded with a champagne bottle - money changed hands frictionlessly.

Ambient Finance. Finally.

🔒 KYC That Doesn’t Make You Cry

When WhatsApp was sold, they then spent another billion dollars on Smile ID after Mark and his team standardized all the licensing and built out the globally accepted KYB and KYC protocol. It helped that the King of America dismantled OFAC and created a zk-SANCTIONS protocol currently being enforced by global treaty. Marks team along with a few leading tech companies led the development.

But I digress some on the macro environment. Back to you.

You onboarded. Once. Painlessly. WhatsApp verified your identity without devouring your soul. No OneDrive links driving you nuts. No spreadsheets with your passport photo circulating between compliance teams. Instead, your proof lives on your device when your national digital ID is verified by your biometrics. When you need to show you’re legit, you send a zero-knowledge “sup bro” handshake to the counterparty. It's like showing your VIP badge at a festival. Or your boarding pass with TSA precheck. No need to strip down.

Regulators are calm. You’re calm. And Meta? What’s Meta?.

🌍 FX at the Speed of Chat

Meanwhile, in the background, magic is happening.

You’re paying your engineering team in Ghana in cedis, suppliers in Indian rupees, and your cousin in the UK in pounds. FX has been commoditized and you know you’re paying a tiny spread. But you know 3 bps isn’t a lot and it’s a small price to pay to keep the WorldDEX running.

WhatsApp forked Uniswap to build the FX engine of their Bank. It’s a global smart router, with AI agents hoovering up rates from corporate customers, local banks, remittance firms, and the occasional unlicensed forex guy. (note: Hawalas still hawala). They call it the WorlDEX. The Bloomberg Terminal of the Global South where read receipts are on and fire emoji reactions spark global trade.

That same zk-”sup bro” above is used to make sure you aren’t sending money to anyone you shouldn’t. It lands where it’s supposed to. Fast, cheap, and no “awaiting beneficiary instructions” purgatory or compliance “holding” hellscapes. Also, notably, your money doesn’t bounce through the US Banking system.

🛠️ Built by Builders, Not Bankers.

Everything is open. There’s an ecosystem treasury funding builders. The international development folks and the crypto folks finally realized they were speaking the same language. Credit apps, savings tools, group finance bots actually work. And are thriving. WhatsApp takes a fee, of course. But only a few basis points here and there and the rest flows back into the system.

There are no ads. No trickery. No terms and conditions that would tongue tie a lyricist.

Just the most useful bank ever imagined.

🌐

Or. Meta could also sell facebook and keep WhatsApp.

In which case I’d say Zuck was Keyser Söze all along.

Will there be a part 2? What happens if Meta sells FB not Whatsapp?